In this particular Blog Post, I will gonna share with you the Importance of saving money from the salary and share 8 Proven ways that actually work to how saving money from the salary. Because, As you know, salaried people have only one source to manage their expenses and run their houses. No Extra source to pay their expenses and save salary money to improve their finance. So, There all expenses depended on the salary. In this situation, They should understand why is saving money important and how to save in a proper way with needs and without heavy wants. So, I keep this matter in my mind and come up with some interesting information that will actually help you. So, stay in touch with me and implement all the strategies that will be involved in this matter. I hope, this will help you. Let’s begin.

Why Money Management Is Important Form Salary?

Money Saving is very important because I said before that a salaried person has only one resource to fulfil all their requirements. If they will save money in a responsible way and save for emergency disasters, save for children and every prospect that can help in their future. Then, This will be helpful and their future will be secure. By saving money they can take early retirements, feel secure from emergency situations, be able to invest in the business, and much more about the finical step. So, now I hope you are able to why saving money is important for a salary, Now let’s dig into some ways of saving money from the salary. Let’s started.

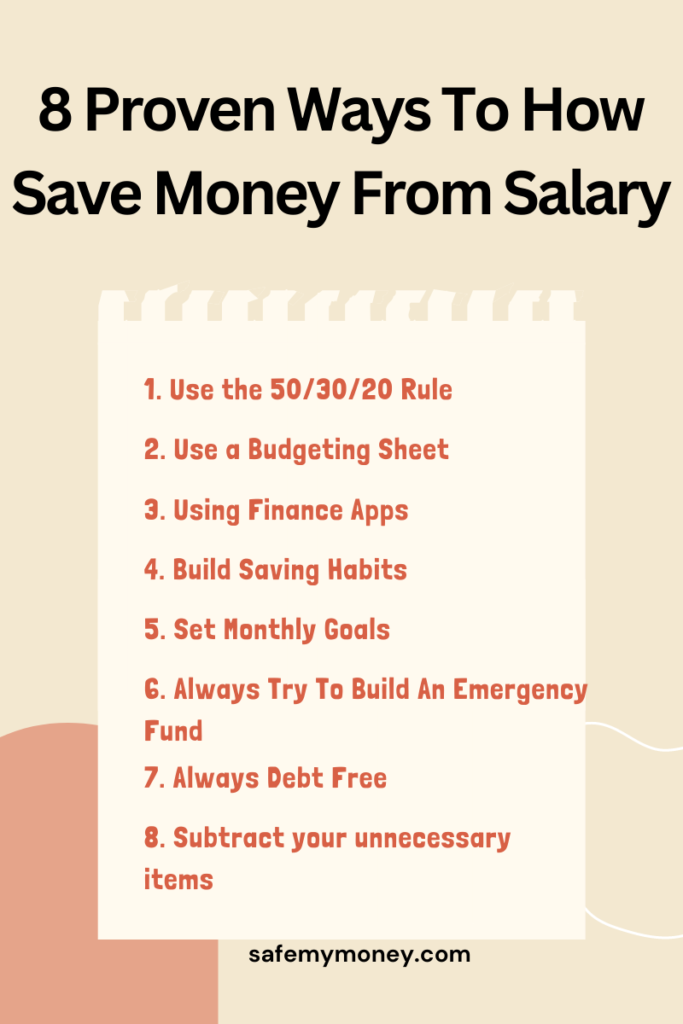

8 Perfect Ways To Saving Money From Salary are given below:

1. Use the 50/30/20 Rule

50/30/20 Rule is perfect for salaried persons. This is a suitable rule to manage, save and use your money very well. The 50/30/20 rules tell you your needs, wants and savings. This Rule teaches you what you need, and what you want. Why need is very important from the wants. Once, You understand this rule and are able to implement it perfectly, then, your command will be strong on your money and you can save much money as you can. Let’s begin and see how this rule actually will work.

50/30/20

50% is your needs. As you know needs are very important and without them, we can’t survive our life. Under the needs, it is your house rent, your groceries, clothes, health expenses and much more that are very essential for us. So, These types of expenses are included in our needs. So, If we make our 50% budget according to our needs. Then, In this way, our life will go perfectly and simply without any financial hassle.

30% is your wants. This rule allows you to you can spend 30% on your wants. If you 50% spend perfectly. Then this 30% can’t disturb your finance and it’s run smoothly and perfectly. That’s why your need and wants will be fulfilled and you can not be overwhelmed and dissatisfied with your job.

Now in the last, 20% is your saving. This rule allows you to save and spend money at the same time without any disturbance. When you implement this rule in yourself then saving is a must for you. So, Then you can be a good finical person and run your finical life easily.

So, This is the best rule for those people who do a job and want to save money from their salary.

2. Use a Budgeting Sheet

Manage your finance with the help of a budgeting sheet. Because It helps you to expand your all expenses in your eyes and you will be clearly identified of your need and wants. You will be fully aware of your finance with the help of sheeting. Budgeting sheets provide you with the best opportunity to manage your finance, save much money, cut out your un compulsory items and much more. Because sheet advantage is that you will note down your expenses and give all of them a certain value. Then spend according to them and always keep them on the sheet. That’s why you will spend your money on the schedule and avoid unnecessary expenses. It will also reduce your debt chances and help to save more money. Because your all money will be spent on planning and no chance to out of control. Download the Budgeting Worksheet from here:

3. Using Finance Apps

This is also a perfect solution for fixed-salaried persons. Personal Finance Apps help you to manage your personal finance and track your expenses very well. It gives you the opportunity to write down your all expenses, connect your account and analyze your all finical report on one platform. You will easily manage your finance, like Investing, Saving, Managing it, debt tracking and much more in one place. Personal Finance tools also give you vital tips about your saving and always keeping from debt. By using these apps you can spend your money according to them and be stress-free from your personal finance. Some best and most popular finance tools are here:

4. Build Saving Habits

Saving is the richest habit and makes you like a riched. Because, When you save your money and at the other hand you secure yourself and your family in a safe zone. By saving money, You can be stress-free, able to handle disaster situations, do some for yourself or your family, debts free and much more. Because by saving money you can strengthen your finance and push yourself into a safe zone. Moreover, you will be confident about your money and manage your finance in any situation. So, Make a habit from now and try to save money on daily basis. It’s can secure you and boost your confidence level about your money.

5. Set Monthly Goals

Take a paper and write down the all financial goals that you want in the coming month. These goals can be your money-saving, returning debts, and anything that you want. Because setting goals it’s boosts your confidence level and you will be confident to achieve anything that you want. It reminds you every time and you will keep your goals in your mind and try to save more money. It also decreases your taking debts chances and making yourself a money-saving person. Moreover, By setting goals you can create more budgeting resources and push your money into the safe buckets.

6. Always Try To Build An Emergency Fund

Saving more money and creating an emergency fund should be the first priority of the salaried person. They should always try saving money for sudden disasters. Because nobody knows that which time they can face many difficulties. By the way, Every person should try to save money for emergency situations, Not for salaried people. Therefore, Save money from the normal situation and make a box or digital account to send specific money on saving it. Then, You can feel free from a difficult situation and at those time you can able to handle tight situations. So, Always try to build an emergency fund and make yourself free from difficult situations.

7. Always Debt Free

This is also an essential part of saving money from the salary. Because when you are in debt then you can’t start a healthy financial journey. It’s always disturbed your finance and stopped you from growing them. Therefore, You should avoid taking on debts and try to make your finance healthy. Because when you take debt then your money is not your money, You are always answerable to another person despite having your own money. So. Always try to avoid debts and try to live on your own money. That’s why you can avoiding to debt and automatically your finical health will be improved. Learn how to avoiding to debt here.

8. Subtract your unnecessary items

Using your money on wasteful and un compulsory items is just a silly thought. Because one it does not give us a good benefit and also our money is waste. You should avoid those spending which does not give you a proper benefit and not for your work. You can easily identify it by thinking before spending. For example: If you want to get Iphone 12, but your pocket Permit you to get Iphone 8 others models. But, You are in your stubbornness and want to get an expensive one. Then this is your huge mistake. By taking this action you can get into debt and fully give bad vibes to your personal finance. So, Identify your wasteful spending and try to avoid them. It’s better for you and your finical health.

So, These were some important steps to saving money from the salary. I shared these steps because most people have issues saving money from their salary. They are struggling with them and trying to improve them. Hopefully, It’s filled with vital knowledge and gives you perfect tips. If Yes! Then I’m gald to that my writing purpose has been fulfilled. You can stay with me for more amazing and easy money management content. Subscribe to my newsletter and stay tuned with me. Thank You!

Conclusion:

After reading this article, You will be able to save money form to your salary. Because It’s filled up with amazing ways to save money from the salary. You will be aware of why saving money is important for a salaried person and how to save it. The perfect guide will help you in a pretty way and make you more confident about your money and try to improve your finance very well. So, Implement all of the given steps on your finance and always try tu strong them.

Thank you for taking the time to share this post. Keep on posting.

Welcome, Hope it’s helpful for you.