You’re running a business, working hard, doing everything right – yet your cash flow is suffering. Paying bills is tough, expenses seem out of control, and profits aren’t translating into actual dollars in the bank. What gives? Don’t panic. There are several ways to improve your cash flow and get your business back on track. You have the power to turn things around without taking drastic measures. The solutions are often simple, it’s just a matter of making them a priority and taking action. Read on for 10 practical ways to fix your cash flow problems and breathe a little easier. By implementing even a few of these strategies, you’ll start to see the difference in your available cash – and your stress levels. Stay positive, you’ve got this!

Read More: Finding the Right Asset Management Group for Your Needs

Understanding Cash Flow and Why It Matters

Cash flow is the lifeblood of any business. If money isn’t coming in and going out properly, your company is in trouble. Let’s look at why cash flow matters and how to improve it.

Cash flow refers to the movement of money in and out of your business. It’s not the same as profitability—you can be profitable but still have cash flow problems if you’re not getting paid on time or have too much tied up in inventory. Good cash flow means you have enough on hand to pay your bills, employees, and other expenses.

Pay closer attention to accounts receivable

Make sure you’re invoicing clients promptly and following up on late payments. Consider offering discounts for paying early to encourage speedier payment. You should also review payment terms with clients to ensure they’re still appropriate for your business.

Look for ways to cut costs

Reduce expenses wherever possible, like renegotiating supply contracts or utility bills. Cut back on discretionary spending too, at least temporarily. Any money you can save or avoid spending will help your cash position.

Extend payment terms with suppliers

Ask suppliers if they’ll give you a little more time to pay, like 45 or 60 days instead of 30. Make sure not to take advantage of suppliers, but an extra week or two can help in a crunch.

By monitoring your cash flow regularly, reducing expenses, improving billing practices and leveraging your supplier relationships, you can overcome short-term cash crunches and achieve lasting stability. Keep a close watch on this critical component of your business, and you’ll be rewarded with the freedom and flexibility that comes from steady cash flow.

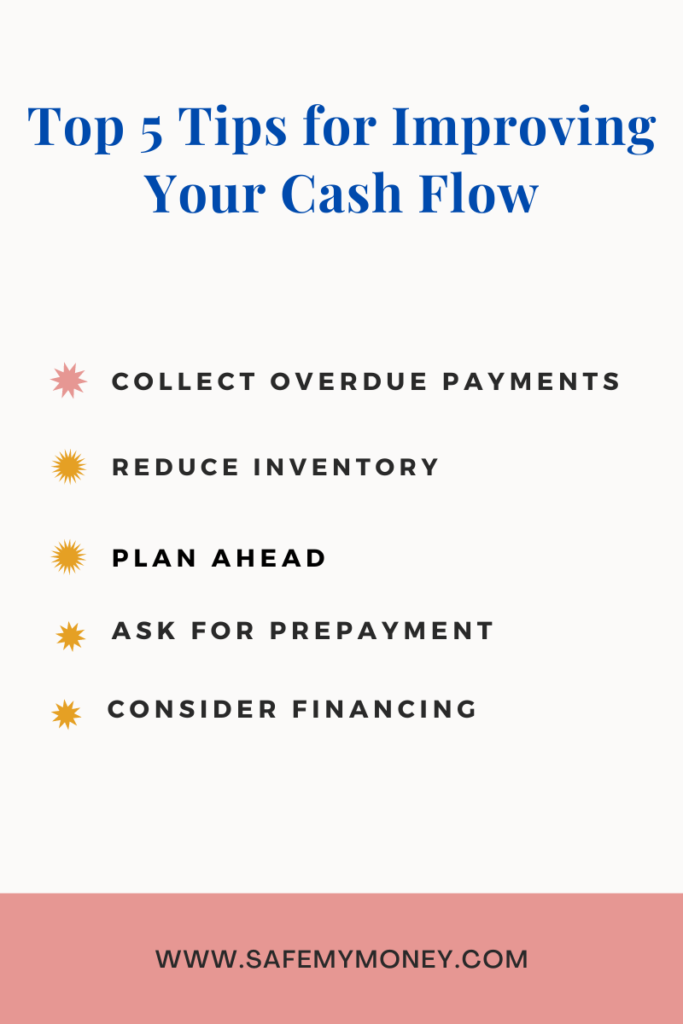

Top 10 Tips for Improving Your Cash Flow

To get your cash flowing again, it’s time for some practical solutions. Here are 10 tips to improve your cash flow:

Reduce Expenses

The less you spend, the more you’ll have available. Look for ways to cut costs in your business and personal budget. Things like eliminating unused subscriptions, buying in bulk, and meal prepping can help.

Read More: Master Your Money: How to Create a Monthly Budget Worksheet

Increase Revenue

Boosting sales and income is an obvious way to improve cash flow. You might raise prices, find new customers, sell additional products or services to existing clients, or develop new revenue streams. Any influx of money will help.

Invoice Quickly

Don’t delay sending invoices. Bill clients as soon as you complete work or make a sale. The faster you invoice, the sooner you’ll get paid.

Offer Discounts for Early Payment

Provide incentives for customers to pay ahead of schedule. Discounts for paying within 10 or 15 days of invoicing, for example, can encourage early payment and improve your cash flow.

Tighten Billing Cycles

Shorten the time between billing and due dates. Instead of net 30 terms, consider net 15 or net 7. The quicker your customers pay, the faster cash will come in.

Collect Overdue Payments

Stay on top of past due accounts and collect what you’re owed. Send reminders, charge late fees if allowed, and take further action as needed. Every dollar collected will positively impact your cash flow.

Reduce Inventory

If you have excess inventory, trim it down. The money previously tied up in unsold goods will now be available to you. You can put it towards other business needs or costs.

Plan Ahead

Forecast your cash needs in advance and make projections about income and expenses. That way you can take action before cash flow issues arise. Look for periods that may be tighter and address them proactively.

Ask for Prepayment

For large new clients or projects, consider requiring upfront payment before starting work. This provides cash to fund operations and the job itself. You can then schedule follow up payments over the course of the engagement.

Consider Financing

If your cash flow problems persist, financing may help. Explore options like loans, lines of credit, factoring, and invoice financing. While not ideal, they can provide the temporary funding you need to stay solvent.

Reducing Expenses to Improve Cash Flow

To improve your cash flow, reducing expenses is key. Here are some ways to cut costs and free up more money each month:

Renegotiate or eliminate recurring bills

Go through your credit card and bank statements and look for any recurring bills, like subscriptions, insurance premiums, or utility bills. See if you can reduce or eliminate any expenses, even if just temporarily. You may be able to negotiate lower rates, switch to lower cost alternatives, or pause some services altogether.

- Cancel underused streaming services, meal kits, gym memberships, etc. Only keep what you actually use.

- Shop around at different insurance providers to find lower premiums for the same coverage.

- See if you can get a lower monthly payment for things like your cable/internet service. Even saving $10-$20 a month can help.

- Turn off lights/electronics when not in use and lower thermostats to reduce utility bills.

Cut out excess food costs

Food is one of the biggest expenses for most households. Look for ways to spend less at the grocery store and on takeout/dining out.

- Make a meal plan based on weekly sales and use a list when shopping to avoid impulse buys.

- Buy in-season produce and generic or store brand items.

- Cook more meals at home instead of ordering takeout.

- Don’t throw out leftovers – eat them for lunch the next day or repurpose into new meals.

- Avoid pre-cut or packaged fruits and vegetables which can cost more.

Look for ways to earn additional income

If possible, taking on a side gig to generate extra money is one of the best ways to improve your cash flow situation. Some options include:

- Drive for a ridesharing service in your spare time.

- Do freelance work like online surveys, website testing, or market research studies.

- Rent out spare rooms, vehicles, equipment, or other assets you own but don’t use regularly.

- Pick up a part-time retail or seasonal job for extra hours.

- Sell unwanted items online or at a local yard sale or consignment shop.

Every dollar counts when improving your cash flow. Making a few small changes to reduce expenses and increase your income can have a big impact on your financial situation over the long run. Keep making continuous improvements and track your progress to stay on track.

Increasing Revenue Streams for Better Cash Flow

One of the best ways to improve your cash flow is by increasing your revenue streams. Rather than relying on a single source of income, diversify to create multiple flows of money coming in. Here are a few ways to boost your revenue and cash flow:

Offer additional products or services

If you have an established business, consider expanding into related products or services that your current customers may be interested in. For example, if you sell gardening tools, offer gardening gloves, plant stakes, and other accessories. Price them attractively as add-on sales or bundle several together at a discount.

Start a side gig

A side gig, or side hustle, is a part-time business you run in addition to your primary job. Turn a hobby into an income source, like selling items you make yourself or offering freelance work related to a skill you have. Drive for a ridesharing service in your spare time or do market research studies. A side gig brings in extra money that goes straight to your bottom line.

Rent out spare rooms or assets

Do you have extra space in your home or garage? An RV, tools, or recreational equipment that sits idle most of the time? Consider renting them out for income. Advertise a spare room in your home on Airbnb, rent out your RV or tools on a peer-to-peer site like Outdoorsy or Neighbor, or lease seldom-used equipment to a rental company. Passive income from renting assets and space can significantly boost your cash flow.

Ask for customer referrals

Satisfied customers are one of the best sources for new revenue. Ask happy clients if they would be willing to refer your business to people they know. Offer an incentive like a discount on their next purchase or a small gift as a thank you for any referrals that turn into new customers. Personal referrals from trusted sources are an easy way to find new revenue streams without a big marketing investment.

With some creative thinking, you can uncover multiple new sources of income and give your cash flow a healthy boost. Consider ways to expand your current business, develop side income streams, rent out underutilized assets, and tap into your customer network for referrals. Improving cash flow is often just a matter of optimizing the resources already at your fingertips.

Setting Up an Emergency Fund to Prepare for Cash Flow Interruptions

An emergency fund is essential for any business to prepare for unexpected cash flow issues. Setting money aside for a rainy day will give you a financial cushion in case sales drop or expenses rise unexpectedly.

Start with $1,000

Aim to save at least $1,000 to start your emergency fund. Put this in a savings account separate from your operating funds. Once you have $1,000 saved, make it a goal to contribute a little from each sale or on a monthly basis until you have 3 to 6 months of expenses in the fund.

Read More: How to Save $1000 This Year With a Simple Money Saving Chart

Cut costs to contribute more

Look for ways to trim your budget so you can put more towards your emergency fund each month. Reduce utility bills by turning off lights, cut back on meals out, or renegotiate with suppliers. Every little bit helps when building up your fund.

Don’t touch it unless absolutely necessary

The emergency fund is only for real financial emergencies – to pay critical bills if cash flow runs out or revenue dries up. Only withdraw money from the fund as a last resort. Once you use it, make paying it back your top priority so it’s there the next time you need it.

Multiple bank accounts

Consider opening a high-yield savings account at an online bank to take advantage of their higher interest rates. This can help your money grow faster. You might also open a separate business savings account at your regular bank for quick access to emergency funds when needed.

Building an emergency fund is a key part of responsible financial management for any business. Make contributing to your emergency fund a priority and consistent habit, and it can give you the security of knowing critical expenses will be covered if your cash flow is ever interrupted.

Conclusion

So there you have it, 10 practical solutions to improve your cash flow and keep your business healthy. Even implementing a few of these strategies can make a big difference to your bottom line and peace of mind. You have the power to turn this situation around – you just have to make the commitment to change and take action. Stay focused on the light at the end of the tunnel, learn from your mistakes, and keep putting one foot in front of the other. Before you know it, cash flow problems will be a distant memory and you’ll be thriving. The only thing stopping you is you, so believe in yourself and get to work! You’ve got this.