Money Management is a little bit challenging for students. Because they have no income sources to generate money and fulfil their requirements in a proper way. They can only survive on their pocket money or other things that help in their financial circle. So, That’s why money management is challenging for them. But on the other hand, It is very important for them. Money Management helps them pay their fees, manage their stationery, hotel and many other fees, without disturbing parents to demand more money for paying their invoices. So, today I will share with you 10 easy ways to money management for students that will actually help and improve their personal finance. So, If you are a student and struggle with money management, you must read it out, keep the points in your mind, and implement them in your daily life. I assure you that you will get incredible results. So, Lets’s started.

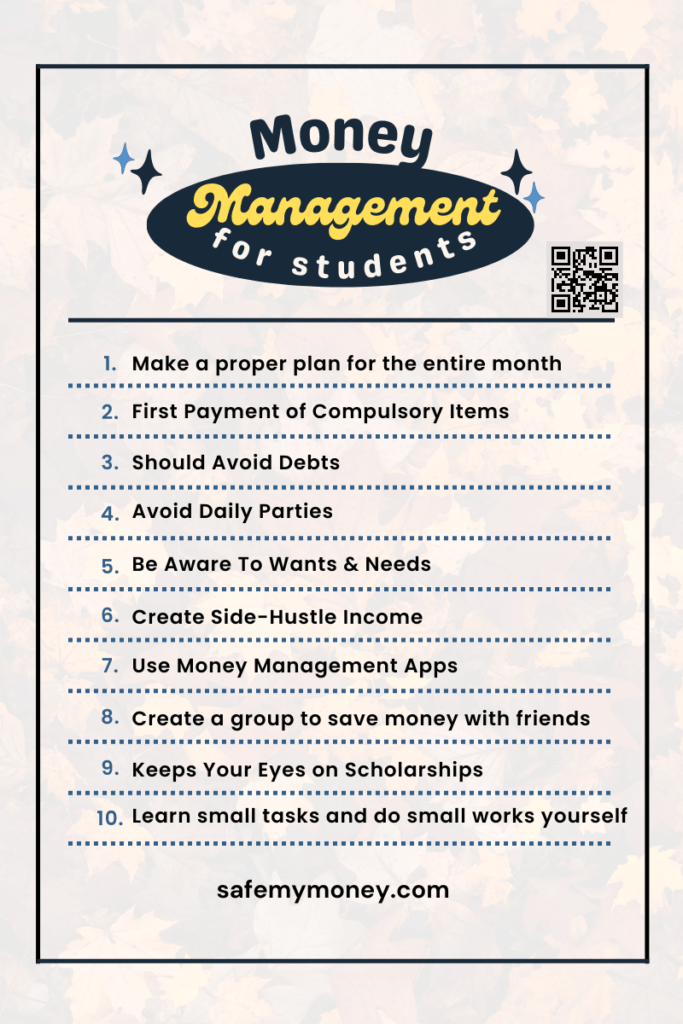

1. Make a proper plan for the entire month.

Suppose you are a student and live in the hostel. Your parents send a specific amount at the start of the month. You have to rely the whole month on this money and clear all expenses in this amouth. Here your money management skill will work for you. If you will good at money management and know to spend money in a proper way then you will clear all your expenses perfectly and also save money from this amouth. So, When the month has started without wasting any time make a plan that fulfils your all essential expenses. Like:

- It can be your College, Hotel, or lab fees.

- It can be your Transport Fees.

- Your Communication bills.

- Your Debts, fine payment.

- Your Health payment.

There are major expenses that need by every student. So, Make a plan and give specific money to each term. Spend according to the schedule and not leave the circle of your made schedule. When you will spend on the scheduled and think a little bit before spending, Then your finance will be improved and not face any issues regarding the money.

2. First Payment of Compulsory Items:

Always first pay for your compulsory and essential items so that no issues come from these phases. I mean compulsory items are your collages fees, transport bill, hotel and glossary bills, each and everything that is included in your need and you can’t survive with them, those items are called compulsory items. So, First pay for them then moves forward. So that no hardly come on your college life. These some fees you should pay at the first are given below:

- Your College, Hostel, Transport Fees.

- Your Hostel Rent.

- Your Internet Bill.

- Your Health Insurance check. (If Any).

- Your Clothes.

These are some important things that you should pay first and I think these are all of your needs as a student. So, Manage these expenses first then make a plan for your want so that you can be depressed and free from any disaster.

3. Should Avoid Debts.

Debts suit that person who generates earnings. Because they are able to put off and return it easily. Students can’t take a loan in their study life, Because they are not strong to return it. So, Always try to avoid debt. Because You have no income resources and you totally rely on your parents or guardians. So, In this step, if you will take a loan and can’t able to return it. Then, It can be difficult for you and your family. Yes! Your studying, If you have no resources to pay your fees and you are not strong as a finical. Then taking debts is right for you. (Will be good if returning limiting is long and lasting).

4. Avoid Daily Parties.

This is a very big way to waste money in just a little time. Yes! We should attend the parties. I’m not saying to leave it out it shi!t. I only say that attending daily and unusual parties is just a money waste. We attend it without any reason and no little advantage of it. Because in your college life many of your friends are addicted to parties and take eating outside of the hostel. They can also addict you too and can worst your finance. So, When anybody invites you and wants your presence, Then stop for 1 second and think about whether it that is important or not. If they are important then you should go, otherwise, you can apologise to them. Which types of parties you should go to are given below.

- You should participate in a whole class party or a whole college party.

- Your very very close friend’s party.

- Your year-ended party.

And some others that you think this is better for joining. But avoid daily activities.

5. Be Aware To Wants & Needs:

This is a little bit close to the 50/30/30 rule. The 50/20/30 rule is that 50% is your need 30% is your want and 20% is your saving. Do you notice needs are bigger them all? Needs are more important than wants. Because we can live without wants but can’t survive without needs. So, That is why the need is more essential for all of them. As a responsible student, You also should be aware them their want and needs. If you can differentiate between both of them perfectly and spend your money on your needs. Then you can be strong financially and save more money and save your learning journey in a cheerful manner.

6. Create Side-Hustle Income:

Side-Hustle is just like a lottery or a little job for a student. And to be honest, This is a very good resource for generating extra income for students. If they get serious it. Side-hustle income is your small pocket that helps in your finical phase and makes your hand easy. You can generate a good amouth of money and continue your study on without any on dependents. You can start freelancing or selling e-books, do affiliate marketing, start blogging and tons of other ways that you can start and generate extra income in your student life. Yes! It becomes your permanent job if you take it seriously. So, If you want money and to make yourself a stronger financial person, Then you should find any side-hustle way that pays you as a maxim amouth and make your and your family’s hand easy.

7. Use Money Management Apps:

Money Management apps are your friends and help you very truly. I think it’s bigger than friends because it saves your money and real friend waste it. Haha….! Just a joke, But Money Management apps can help you to manage your personal finance and make them easy for you. You can manage your money by using them, It can give you vital tips and tricks that can help you in your personal finance. As a student, Money Management tools will help you to track your expenses, your daily and weekly cuts records, your saving information, your debts information and so so forth. You can easily track your finance by using them and move forward accordingly to their analytics. So, As a student, you must use these tools because in college life nobody guide you related to your money. So, I think it’s essential for you.

8. Create a group to save money with friends:

This is also an excellent way to save money and I think in this case whole candidate’s interest matters. Because when your whole group make a plan and promise to save a maximum of daily 1$ then implementation will be key and obligatory. So Now, If you live in a hostel and you have lots of roommates and friends. So you can invite them and convenience to the cheerful manners that if we make a plan and say no to the unusual expenses and avoid daily parties and save that money and invest it to any useful place then it’s become profitable for us and that’s why we can strengthen our finance. I assure you if you take this action and convenience your friends then your friends listen to your this advice and take it seriously. So, Try one time and get disastrous results.

9. Keeps Your Eyes on Scholarships:

Most of the students when they get admission to the institute and will calm down. They don’t try to find any scholarship programs that are live in their circle. They only survive on their own fees and do not know the pretty scholarship programs that can beneficial for them. Because many scholarship programs are made for students regarding their college fees, hostel fees and many more. So, We should always try to find a scholarship program that can help us in our studies and can decrease our financial wright.

10. Learn small tasks and do small works yourself:

Doing your homework is the best habit and most respectable habit. Do your homework by yourself, It’s good for you and your finance. Because when you will do your little work yourself and not depend on another person. So that you can save your little money. Because when another does this work for you then definitely they will get payment. So, Do your little work yourself and save your money in these little ways. Some types of task that you can do by yourself is given below:

- You can clean your room by yourself. (That’s the way you can save duster charges)

- You can learn to cook and do it by yourself.

- Learn laundry and a little about tailor work.

And much more small tasks that you should learn and do yourself. Apparently, It seems like very little but its impact is very big. So, Always do your work yourself and save money as much as possible.

So, These were some essential tips for the money management of students. If you will implement these steps on your own and spend your money on them. Then I assure you you will be able to save more money and your finance will be strong. And automatically you will feel free from the essential college expenses. So, Always try to best and save much money as you can. Hopefully, This stuff was helpful for you. Stay Tuned for more amazing content!

Consulcison:

After Implementing the given steps, You will be able to depress free from college expenses and you can be able to save money as you can. The harsh tips will help you in your personal finances and give you a path that how can save more money as well as make more money. So, After reading this implementation is Obligatory. Without implementation, the reading is just the worst. So, Implement these steps in your life and try to improve your finance healthy.