You want to save more money each month, but it feels like an impossible challenge. Between the rising costs of everything and unexpected expenses popping up, your budget always seems stretched thin. The truth is, saving money isn’t rocket science. With a few simple tricks and techniques, you can stash away an extra $500 per month without making huge lifestyle changes. In this article, you’ll discover 21 ridiculously easy ways to cut costs and boost your savings account balance. Some of these tips may only save you $5 or $10 at a time, but they add up quickly when you implement several of them. Before you know it, you’ll have an extra $500 in the bank each month and will be well on your way to achieving your financial goals. Saving money never felt so easy!

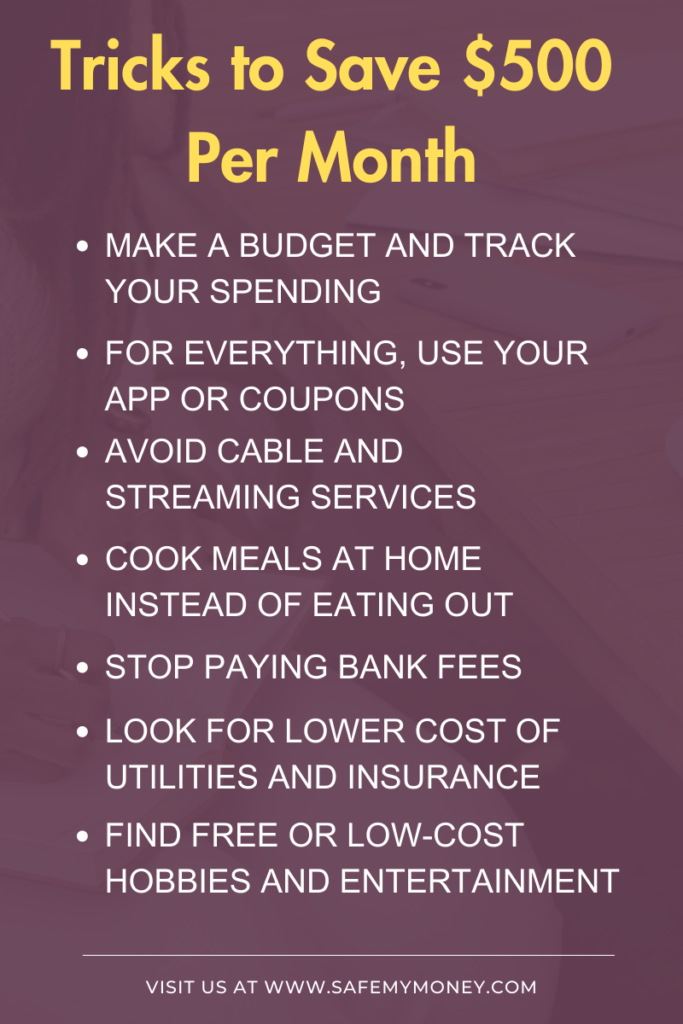

Make a Budget and Track Your Spending

The first step to saving money is knowing exactly how much you spend and on what. Make a budget that tracks all your income and expenses. Go through your bank and credit card statements, receipts, and bills to record everything from the past few months. Once you have a clear picture of your spending, you can look for expenses to cut or reduce.

Look for ways to cut recurring bills like cable, insurance, or utility costs. Call your providers and ask if they offer any discounts for long-time customers or if they can lower or drop certain fees. You can easily save $50 to $200 per month this way.

Examine how much you’re spending on food, especially dining out and takeout. Cooking more meals at home using groceries is a simple way to save $200 or more each month for a family. Buy ingredients in bulk when possible and plan your meals each week before shopping to avoid waste and impulse buys.

Reevaluate any subscriptions or memberships and cancel anything you’re not using. Things like streaming services, gym memberships, credit cards with annual fees, etc. can cost $50 to $500 per year and provide little value if not utilized.

Once you’ve made some cuts, set a strict budget and spending limits in each area. Track your actual spending for a few months to make sure you’re staying within budget. Make adjustments as needed. With time, your frugal habits will become second nature and the savings will really start to add up. Sticking to a solid budget and cutting unnecessary costs is the key to saving $500 or more each and every month.

Cut the Cord: Cancel Cable and Streaming Services

One easy way to save major money each month is to cut the cord on cable and streaming services. Between cable packages, streaming sites like Netflix and Hulu, and add-on channels, you could be paying $100 or more per month.

Cancel Your Cable

Call your cable company and cancel your cable TV package. Keep your internet service if you still want WiFi, but ditch those hundreds of channels you never watch. You’ll save at least $50 to $100 per month. If you do want to keep some live TV, consider free over-the-air channels or a cheap streaming service like Sling TV or YouTube TV.

Choose One or Two Streaming Services

Pick one or two streaming services with your favorite shows and movies and cancel the rest. For example, keep Netflix for $9 per month and Hulu for $6 per month, but cancel HBO Now and CBS All Access. That could save you $20 to $30 per month. If you can’t decide between a few, rotate through them – have Netflix for a few months, then switch to Hulu, and so on.

Share Accounts with Family

If you have close family or friends you trust, consider sharing streaming accounts to cut costs. For example, share a Netflix and Hulu account with two other people. You each pay $5 per month, so you get both services for just $10 total. Just be sure to create separate profiles on the services for your viewing preferences and watchlists.

Making a few changes to how you access entertainment can result in huge monthly savings. Ditch cable and excessive streaming services, choose one or two you really want, and consider sharing accounts. Your bank account will thank you!

Cook Meals at Home Instead of Eating Out

Cooking meals at home is one of the easiest ways to save money. When you eat out, you’re not only paying for the ingredients in your meal but also the labor, utility costs, and profit margin of the restaurant.

Make a meal plan for the week ahead and grocery shop accordingly. Buy ingredients for meals you can cook in large batches, like soups, stews, and casseroles. Not only does this minimize waste, but the leftovers can serve as lunches or additional dinners. Focus on less expensive proteins like beans, eggs, and in-season vegetables.

Cook once, eat twice

Double or triple recipes when cooking at home, then eat the leftovers for lunches or freeze portions for later. Things like pasta sauce, chili, lentil soup, and enchiladas freeze well and are easy to reheat. This strategy cuts down on cooking time and saves money versus eating out multiple times a week.

Avoid convenience foods

Pre-cut or packaged fruits and vegetables, frozen dinners, and snack foods may save time but cost significantly more than their whole ingredients. Skip the pre-washed lettuce and salad kits in favor of whole heads of lettuce. Buy potatoes, carrots and other veggies whole instead of pre-cut. Compare the unit prices to see the difference.

Use what you have

Check your pantry, fridge and freezer before making a meal plan or heading to the store. See what ingredients you already have on hand and build meals around them. Use up leftovers and make the most of whatever you’ve got to avoid food waste and extra trips to the grocery store. Get creative with recipes by substituting similar ingredients.

Following these tips can easily save you $500 or more per month in dining out costs. Home cooking using fresh, whole ingredients is budget-friendly and healthier. With some practice, you’ll become an accomplished home cook, and occasional meals out will become a treat rather than the norm. Your wallet and waistline will thank you!

Stop Paying Bank Fees

Bank fees are one of the biggest wastes of money and the easiest ways to save each month. Do you even know how much you’re paying in fees each year? It’s probably a lot more than you realize. Here are some tips to stop the bleeding and keep more money in your pocket:

Choose a bank with no ATM fees.

Banks like Ally, Axos, and Discover offer reimbursement of ATM fees charged by other banks. That means you can use virtually any ATM for free. If your current bank charges for ATM use, consider switching to a bank with no ATM fees to save $3-$5 each time you need cash.

Stop overdrawing your account.

Opt out of overdraft protection on your accounts so charges that exceed your balance are simply declined rather than triggering an overdraft fee. Overdraft fees can be $35 per transaction. Instead, link your checking account to a savings account to automatically transfer money if needed to cover charges. Or use budgeting tools to avoid overspending in the first place.

Pay bills on time.

Late fees for bills like credit cards, utilities, rent, insurance, etc. are completely avoidable. Set up auto-pay or schedule payment reminders to ensure all your bills are paid on time, every time. Just one late fee of $25-$50 per month can add up to $300-$600 per year in unnecessary charges.

Negotiate or cancel unused fees.

Do you pay monthly fees for things you don’t use like safety deposit boxes, wire transfers, stop payments, or account maintenance? Call your bank and ask if fees for unused services can be waived or reduced. If not, consider closing accounts with high monthly fees you don’t benefit from.

By making a few simple changes to how you bank, you can easily save $500 per year or more. That’s money that can be put to better use paying off debt or saving for important goals. Take control of your accounts today and stop giving your hard-earned money away to the banks in unnecessary fees each month. Keep more of your own money—you work hard for it!

Stop Paying Bank Fees

One of the biggest drains on your budget each month is likely the interest payments on your debt. Whether it’s credit cards, student loans, auto loans, or a mortgage, interest charges can really add up. Here are some ways to reduce or eliminate those pesky debt payments.

Pay off high-interest debts first. Focus on paying off debts like credit cards that often have eye-popping APRs of 15-30% or more. Make minimum payments on low or no-interest debts while putting any extra money toward the high-interest balances. Once paid off, roll those payments into the next highest-rate debt. This “snowball effect” will help eliminate those balances quickly.

Consolidate high-interest debts. If you have high-interest credit cards or other unsecured debts, consider consolidating them through a lower-interest personal loan. This can reduce your interest charges and allow you to pay the debt off faster. Be sure to stop using credit cards once consolidated though, or you’ll end up in an even bigger hole.

Renegotiate or refinance existing debts. If you have a good payment history, call your credit card companies and student loan servicers and ask if they will lower your interest rate. You have nothing to lose, and they may work with you to keep your business. With mortgages and auto loans, consider refinancing to a lower rate to reduce payments. Interest rates are often lower now, so you may save thousands over the life of the loan.

Pay more than the minimum. Once you’ve reduced interest rates as much as possible, start paying more than the minimum due each month. Even increasing by an extra $50 or $100 can shave months or years off the life of the debt and save on interest. Payments applied to the principal reduce the balance faster.

Consider temporarily suspending payments. If money is extremely tight, call your lenders and student loan servicers and ask if you qualify for a temporary suspension or reduction in payments. Many will work with customers experiencing financial hardship. Be very careful with this option though, as interest will likely still accrue during the suspension period.

Reducing or eliminating debt payments is key to gaining control of your finances and keeping more money in your pocket each month. With lower interest and smaller balances, you’ll finally be able to start building wealth rather than paying so much to creditors. Keep chipping away at those debts and financial freedom will be yours!

Look for Lower Cost of Utilities and Insurance

When it comes to lowering your monthly bills, your utilities and insurance premiums are two of the first places to look. Even small changes can add up to big savings over the course of a year.

Check with your utility providers to see if they offer budget billing or balanced payment plans. These options average out your bill over 12 months so you pay the same amount each month. This makes it easier to budget and avoids higher seasonal bills in the summer or winter. Ask if they provide any discounts for enrolling in autopay or paperless billing as well.

See if your insurance companies will provide any discounts for bundling multiple policies together, good driving records, home security systems, or for being a longtime customer. Raise your deductibles to lower premiums if you’re able to pay more out of pocket in the event of a claim. Compare rates with other top-rated companies—you may find lower premiums for the same coverage.

When your contracts are up for renewal, shop around to find lower rates from competitors. Be ready to provide details about your current plan and see if they can match or beat what you have. Don’t be afraid to negotiate—many companies would rather keep your business at a discounted price than lose you altogether.

Consider dropping coverage you don’t really need. For example, you may be paying for roadside assistance you never use or could lower coverage limits on older vehicles. Look at how much you’re paying for entertainment subscriptions and see if you can cut the cord on some streaming services or premium channels. Any money you can shift from monthly bills into savings or paying off debt will be money well saved.

With some time and persistence, you can uncover opportunities to reduce your utility and insurance costs by up to $100 or more per month. Keep searching and stay on the lookout for ways to cut your monthly obligations. Your budget and bank account balance will thank you.

Find Free or Low-Cost Hobbies and Entertainment

Finding hobbies and entertainment that won’t break the bank is key to saving money each month. Instead of expensive nights out at the bar or lavish vacations, look for free or low-cost activities to fill your time.

Explore Your Local Library

Public libraries offer a wealth of free resources like books, ebooks, audiobooks, movies, music, magazines, and newspapers. Some also provide free Wi-Fi, classes, and community events. Get a library card and start borrowing materials to enjoy at home. This can easily save you $30-$50 per month or more.

Take Up Outdoor Activities

Outdoor hobbies are often very budget-friendly. Go for walks or jogs in your neighborhood, have a picnic at a local park, stargaze at night, go geocaching, or learn to identify birds and plants in your area. Buy gear as needed at a secondhand store. These types of activities typically only cost a few dollars per month, if anything at all.

Host Game Nights

Instead of going out to bars or clubs with friends, host a game night at your place. Play classic board games or party games that you already own like Pictionary, charades, Cards Against Humanity, or tabletop roleplaying games. Ask guests to bring snacks to share. This can save at least $20-$40 per person compared to a night on the town.

Learn a New Skill Online

The Internet offers unlimited opportunities to learn new skills for little to no cost. Take free online courses on websites like Coursera, Udemy, or Udacity, watch tutorial videos on YouTube, or read how-to guides to learn skills like coding, photography, graphic design, or a new language. Then, practice your new skills as an enjoyable hobby. Feed your mind for free and save money by avoiding paid classes.

Finding enjoyable hobbies and entertainment that don’t require a lot of money will allow you to avoid expensive nights out and save at least $100 per month or more. Take advantage of free resources in your local community and online to fill your time with low-cost fun. Your wallet will thank you!

Use Coupons for Discounts on Everything

Using coupons or discount apps is one of the easiest ways to save money on just about everything. Nearly every store, from grocery to retail, offers coupons, and the savings can really add up.

\n\n###Check Your Mail for Coupons

Don’t toss those coupon mailers in the recycling bin. Take a few minutes to go through them and clip any coupons for products you actually use. You can often find coupons for $1 off or buy one, get one free.

\n\n###Download Coupon Apps

In addition to physical coupons, many stores offer digital coupons you can load to your loyalty card or redemption app. Some of the most popular apps are:

- Coupons.com – They offer coupons for groceries, home goods, clothing and more. You just load the coupons to your card and the discount is taken off at checkout.

- Ibotta – They offer cash back for selected products. All you have to do is choose offers, buy the items, scan your receipt and you’ll get money added to your Ibotta account. You can then cash out to PayPal or gift cards.

- Checkout 51 – Similar to Ibotta, they offer cash back for selected grocery items. Browse their offers, buy the products, scan your receipt and get paid.

\n\n###Stack Your Savings

For the biggest savings, use store coupons in combination with coupon apps and loyalty programs. Many stores also regularly run weekly sales on certain products. Time your shopping trips so you can take advantage of app offers, coupons and weekly sales all at once. With a little strategic planning, you can easily save $10-$20 per shopping trip. Over the course of a month, that can add up to $100 or more in savings.

By using available coupons and apps for the stores where you regularly shop, you’ll find yourself saving money on essentials as well as fun extras. Every dollar saved adds up, so put these techniques to use and watch your savings grow. With consistent effort, you can save $500 per month or more.

FAQs: Common Questions on Saving Money Techniques

Saving money often comes with a lot of questions. Here are some of the most frequently asked ones to help you on your money saving journey:

How much should I aim to save each month?

A good rule of thumb is to save at least 10-15% of your take home pay each month. If you can save more, that’s even better. Start by saving any amount, even if it’s just $20 or $50 a month. Then, slowly increase the amount over time as you pay off debt and reduce expenses. Every little bit helps.

What are some easy ways to save money each month?

Some painless ways to save include:

- Make your coffee at home instead of buying it. This can save you $3-5 per cup.

- Pack your lunch for work instead of eating out. You can save $5-10 per meal.

- Cancel unused subscriptions and memberships. This can save you $10-50 per month.

- Buy generic or store brand items instead of name brands. You can save up to 50% on staples like food, over-the-counter drugs, and household supplies.

- Use coupons or your app for discounts on items you need. You can save 10-90% off with couponing.

- Cut the cord on cable TV. Switch to streaming services only. This can save $50-100 per month.

How do I make a budget and stick to it?

The keys to successful budgeting are:

- Track your spending for a few months to see where your money is going each month. Look for expenses you can reduce or eliminate.

- Set clear financial goals like saving for a down payment on a house or paying off high-interest debt. This will keep you motivated.

- Create a realistic budget allocating your income to essential expenses first, like housing, food and transportation. Then allocate the rest to your goals and discretionary items.

- Review income and expenses regularly and make adjustments as needed. Track your progress to stay on budget each month.

- Look for ways to boost your income or earn additional income on the side to have more to put towards your goals.

- Reward yourself when you meet your goals to stay motivated. But don’t overspend your budget!

Budgeting does take work and discipline, but the payoff can be life-changing. Stick with it and stay committed to your financial goals. You’ve got this!

Conclusion

You now have 21 practical money saving techniques in your arsenal to start putting an extra $500 back in your pocket each month. Pick and choose the options that work best for your lifestyle and budget, then get saving! Even choosing just a few of these tricks can add up to big savings over time. What are you waiting for? Start implementing these money saving tips today and watch your savings balance grow. Before you know it, you’ll have an extra $6,000 each year that you can put towards important financial goals like paying off debt, saving for a family vacation or funding your kids’ college education. Every dollar counts, so start saving where you can and build from there. You’ve got this!