Hey there! I want to talk to you about something that’s been on my mind lately – financial habits. I used to think that my financial situation was just something that happened to me, but now I know that it’s really about the habits that I have formed over time. And let me tell you, bad money habits can be a real downer. Debt, stress, and feeling like I’ll never be able to get ahead – it’s not a great feeling.

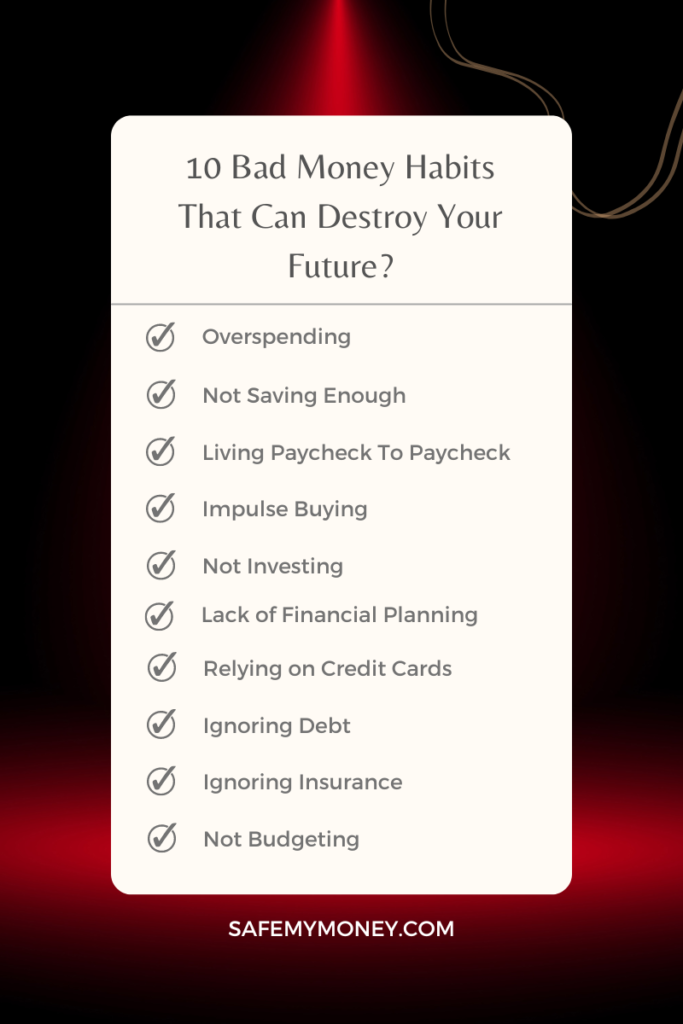

But the good news is that I’ve also learned that good financial habits can turn things around. By setting goals, creating a budget, and investing wisely, I’ve been able to make significant changes in my financial life. And I must say, it feels amazing! I want to encourage you to take the same steps towards financial freedom. By avoiding bad money habits like overspending, relying on credit cards, and ignoring debt, and adopting good habits like saving for emergencies, investing for the future, and seeking professional financial advice, you can build a solid financial foundation that will serve you well in the long run.

It’s not always easy to make changes, but I promise you that it’s worth it. You deserve a secure and stable financial future, and taking steps towards good financial habits is the first step towards making that happen. So let’s do this thing together! With a little determination and some helpful strategies, we can build the financial future we’ve always dreamed of.

1. Overspending

Let’s talk about overspending. I used to be the king of overspending, and it was a habit that left me constantly stressed about my finances. By taking control of your spending habits and learning to prioritise what’s truly important, you can break free from the cycle of overspending and achieve financial freedom.

- Create a budget:

By creating a budget, you’re giving yourself a roadmap to financial success. You’ll know exactly how much money you have coming in, how much you’re spending, and where you can cut back to save more. It might take a little bit of effort to get started. But, When you will start creating a budget, Your all financial circle will be run healthy.

- Tracking expenses:

Do you struggle to keep track of your expenses? Trust me, I get it – it’s easy to lose track of where our money is going. But, by taking a little time to track your expenses, you can gain a better understanding of your spending habits and identify areas where you can cut back. So, grab a notebook and let’s get started.

- Working with a financial advisor:

It’s like having a personal coach who helps you navigate the complexities of investing, planning for retirement, and achieving your financial goals You can get expert advice, customised financial planning,

2. Not Saving Enough

It’s time to take control of your financial future! I know saving money can be challenging, but ignoring it altogether can lead to serious financial trouble down the road. By making a conscious effort to save just a little bit each month, you can start building a strong financial foundation and ensure a more secure future. Don’t wait any longer to start saving – your future self will thank you!

- Setting a savings goal:

Set yourself a savings goal, and commit to it. Whether it’s a percentage of your income or a fixed amount, make it a priority to save regularly towards your goal. With each dollar saved, you’re one step closer to financial stability and a brighter future.

- Making saving automatic:

One way I ensure I save enough is by making it automatic. I set up a direct deposit from my paycheck into a separate savings account, so I don’t even have to think about it. By doing this, I’m consistently building my savings without even realising it, making it easier to reach my financial goals.

- Budgeting apps:

One strategy that has helped me with budgeting is using budgeting apps. These apps allow me to track my expenses, set financial goals, and stick to a budget. They also provide helpful reminders and notifications to keep me on track. With the convenience and accessibility of these apps, it’s easier than ever to take control of my finances and build a better financial future.

Read Related Article About 10 Unexpected Benfits of Saving Money

3. Living Paycheck To Paycheck

I used to live paycheck to paycheck, struggling to make ends meet every month. But by adopting new financial habits and focusing on budgeting and saving, I was able to break free from the cycle of living paycheck to paycheck. It’s not always easy, but with determination and discipline, you can start building a more stable financial future and take control of your finances.

- Create a budget:

Create a budget to take control of your finances and achieve your financial goals. You can identify areas where you can cut back on expenses and save money by tracking your income and expenses. Don’t let your finances control you – take charge and create a budget today!

Read More: How Does Budgeting Help You Save Money: 5 Easy Budget-Making Tips

- Reducing your expenses:

By reducing your expenses, you can save more money and achieve your financial goals. This can be done by cutting back on unnecessary expenses, finding cheaper alternatives, and prioritising your spending.

- Build an emergency fund:

By setting aside a small portion of my income each month, I can build up a reserve to help me weather any financial storms that may come my way. So let’s get started and secure our financial future!

4. Impulse Buying

Impulse buying is one of my biggest struggles. I’ve started to be more intentional with my purchases, whether I need or just want something. It’s not easy, but with every purchase that I resist, I feel more in control of my finances and closer to my financial goals. Let’s say goodbye to impulse buying and hello to financial freedom!

- Plan your purchases:

Hey, listen up! I’ve got a great tip to help you save money – plan your purchases be terrible at impulse buying, but now By making a list of what I need before I go shopping, Iaavavoidsavoidstion to buy unnecessary items. Trust me, this simple step can add up to big savings over time.

- Consider alternatives:

Next time you’re faced with a decision, whether it’s a purchase or a life choice, take a step back and consider your options. Explore different paths, and the pros and cons. By considering alternatives, you may find a better solution that saves you money, time, and stress.

5. Not Investing

When you don’t invest your money, you’re missing out on the opportunity to grow your wealth and secure your future. Start investing today and take control of your financial destiny!

- Educate yourself:

Take the time to research and learn about different investment options. By educating ourselves about investing, we can take control of our financial futures and build wealth.

- Make Investing a Habit:

By investing regularly. Set up automatic contributions to your investment accounts so that you don’t have to remember to do it manually each time.

6. Lack of Financial Planning

Without a solid plan, it’s easy to get sidetracked by short-term expenses and impulse buys. But with a little bit of effort and discipline, you can develop a financial plan that will help you achieve your long-term goals and secure a stable financial future.

- Set Clear Financial Goals:

It is essential to take the time to evaluate your current financial situation and determine what you want to achieve in the future. Your financial goals should be specific, measurable, and achievable. Once you have set your goals, you should develop a plan to achieve them.

- Make a Spending Plan:

Identify your income and spending by making a budget. This will help you keep track of your spending and ensure that you are living within your means. You should also track your spending to identify areas where you can cut back and save more money.

7. Relying on Credit Cards

Believe me, I have learned the hard way that relying too heavily on credit cards can lead to a never-ending cycle of debt and financial stress. When we use our credits, we’re borrowing money that we have to pay back, often with high-interest rates attached. Instead, let’s prioritise responsible credit card use and explore alternative payment methods, like cash or debit cards, to avoid the pitfalls of relying on credit cards.

- Set Guidelines:

Fortunately, By setting clear guidelines and following responsible financial practices, you can maintain a healthy financial outlook and avoid unnecessary debt.

- Monitoring Credit:

Setting a budget and monitoring credit card balances can also help manage credit card use. By keeping track of expenses, you can stay on top of your finances and avoid unnecessary debt.

8. Ignoring Debt

I know from personal experience how easy it can be to ignore debt. But the truth is, debt can quickly spiral out of control if left unaddressed. Resist the urge to let debt rule your life. Take the first step towards financial freedom by addressing your debt today.

- Tackle Debt:

If you tackle your debt then create a debt repayment plan, negotiate with creditors and seek professional financial advice.

9. Ignoring Insurance

Listen up! Ignoring insurance can lead to massive financial consequences. Without proper insurance coverage, you could end up facing expensive medical bills, property damage, or legal liabilities. So let’s make a change today and prioritise insurance coverage for your health, property, and liability.

- Purchase Insurance Coverage:

Research the different types of insurance. Compare policies to find one that provides the coverage you need at an affordable price. Review regularly and update your coverage as needed to ensure you have sufficient immunity against unforeseen risks.

10. Not Budgeting

As someone who used to live paycheck to paycheck, I know how easy it is to fall into the trap of not budgeting. With a budget in place, you can plan for the future, prioritise your spending, and avoid overspending. Take the time to create a budget and stick to it, and you’ll be amazed at how much control you have over your finances. Don’t let not budgeting hold you back from achieving your financial goals.

To help you manage your budget, consider using budgeting tools and resources, such as budgeting apps or spreadsheets.

Conclusion

In this article, we’ve covered some common bad money habits that can harm our financial stability. But don’t worry – it’s never too late to turn things around and start building a strong financial foundation. We can do this by adopting good financial habits such as creating a budget, paying off high-interest debt, investing for the future, seeking professional financial advice, and using credit cards responsibly.

By making small changes today, we can enjoy a more secure and stable financial future tomorrow. So let’s take the first step towards good financial habits today and enjoy the benefits in the future. Remember, good financial habits are key to achieving our financial goals and building wealth. So let’s get this done!